Questions & Answers

If you have a question that’s not answered here, please contact us.

If you have not retired by 31 October 2025

Q1. What is GMP?

GMP is a minimum pension that a workplace pension scheme provides.

It only applies to people who were contracted out of the Additional State Pension (or State Earnings Related Pension) between 6 April 1978 and 5 April 1997.

Schemes could 'contract out' so that members and the employer could save on National Insurance. In return, the scheme had to guarantee that the member would get a certain minimum level of pension when they retire.

This minimum level of pension was designed to be at least as much as the Additional State Pension a member would get if they had not been contracted out.

Q2. I have GMP but I haven’t received a letter yet. When will I get one?

At the moment we’re only writing to members who are already getting their pension. Before you take your pension, we’ll work out how much pension you would have built up if you were the opposite sex. This will show us If we need to increase the overall value of your pension.

As your retirement date approaches, we’ll send you information about taking your benefits which takes into account the change to GMP rules.

Q3. Is every member with GMP having their GMP converted?

Yes. All affected members of the Scheme are going to have their GMP converted into normal pension. This will happen at different times for different members.

Q4. When will my GMP be converted?

Your GMP will be converted at the point at which you retire, or if you choose to transfer out of the Scheme.

For ‘phase 1’ pensioner members (who received figures in September 2025)

Q5. What is GMP?

GMP is a minimum pension that a workplace pension scheme provides.

It only applies to people who were contracted out of the Additional State Pension (or State Earnings Related Pension) between 6 April 1978 and 5 April 1997.

Schemes could 'contract out' so that members and the employer could save on National Insurance. In return, the scheme had to guarantee that the member would get a certain minimum level of pension when they retire.

This minimum level of pension was designed to be at least as much as the Additional State Pension a member would get if they had not been contracted out.

Q6. I have GMP but I haven’t received a letter yet. When will I get one?

You should have received a letter about your GMP in September 2025.

If you have not received a letter, please contact Aptia.

Q7. Is every member having their GMP converted?

Yes. All affected members of the Scheme are going to have their GMP converted into normal pension.

Q8. When will my GMP be converted?

We wrote to phase 1 members in September 2025 showing how your pension will be affected. We plan to pay you your updated pension in February 2026.

Q9. Is my pension update caused by the High Court ruling or by converting GMP?

This answer is for Phase 1 members. Any update to your pension is a result of both of these changes. The results of these exercises have been combined to make sure you receive any back payments you are due and the correct amount of pension from 1 February 2026 onwards.

Q10. Why does the breakdown with my September 2025 letter not show any GMP?

This answer is for Phase 1 members. In their GMP conversion letters, most pensioner members will see their pension before conversion split into normal pension and GMP. However, some members will not see GMP in this breakdown, because they are below a certain age.

GMP is payable from GMP Age (GPA). This is age 65 for men and age 60 for women. When you reach GPA, your pension is split into ‘normal’ pension and GMP. The amount of pension you get doesn’t change, it’s just a different way of breaking down the different parts of your pension.

If you’re getting a pension and you’re below your GPA, GMP isn’t yet part of your pension. So it’s not included in the full breakdown we sent you. When we convert your GMP into normal pension, your pension will be adjusted to take this into account.

Here’s an example

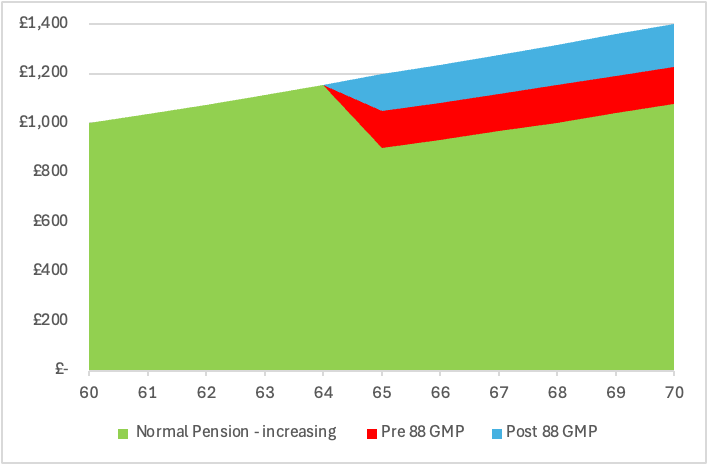

The graph below shows a pension for a 60-year-old man. This is before we convert GMP. You can see how his pension is made up differently from age 65.

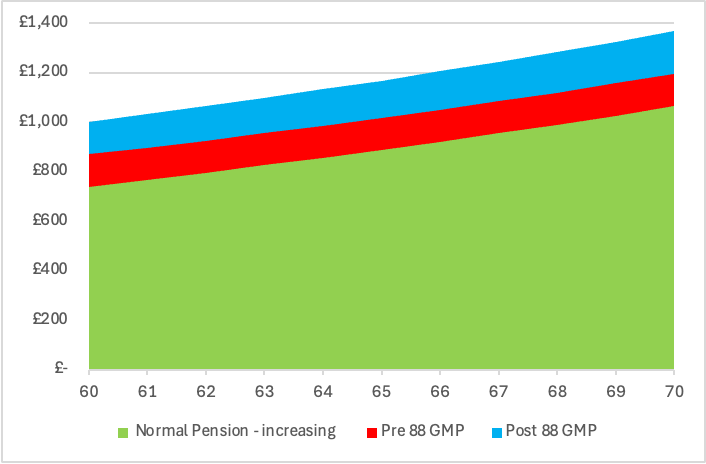

When we convert his GMP into normal pension, his pension will look more like this:

When we convert his GMP into normal pension, his pension will look more like this:

Your pension will not go down at the time of conversion.

Your pension will not go down at the time of conversion.

The Scheme Actuary will make sure the overall value of your benefits will be at least as high after conversion as before.

Q11. Why do I have to wait until February 2026 for my pension to be updated?

This answer is for Phase 1 members. We’ve decided to update pensions from February 2026, so that we can update as many pensions as possible at the same time.

In their September 2025 letter, some members will have been offered the option to exchange some or all of their future annual increases on part of their pension for a higher non-increasing pension now. This option is called Pension Increase Exchange.

We need to allow these members approximately three months to decide whether PIE is right for them. This is in line with the Code of Good Practice on incentives exercises.

Once those three months have passed, we then need to allow the administrator time to finalise the changes to everyone’s pension, including those who have chosen to take PIE. This means the appropriate time to update all affected pensions is February 2026. All calculations will be based on the correct date, so no one will miss out on any pension.

Q12. If my one-off payment puts me in a higher tax bracket, can I claim back the extra tax?

This answer is for Phase 1 members. For most members who receive a one-off payment, there will be no change in the rate of tax they pay. For a small number of members, it’s possible their one-off payment will push them into a higher tax bracket for the year.

If you’re due a one-off payment, we’ve included a breakdown of that payment by tax year with your September letter. This shows HMRC that, for tax purposes, this is a back payment spread over several years, rather than a single lump sum payment.

If HMRC does apply extra tax to your payment, you can download this template letter, complete your details, and send the letter to HMRC along with the tax breakdown we’ve sent you.

We can’t guarantee this will result in your extra tax being reimbursed, but it will give HMRC the information they need to check if you are due a repayment.

Q13. My September 2025 letter refers to the Lifetime Allowance. What is this?

This answer is for Phase 1 members. The Lifetime Allowance (‘LTA’) was a limit, set by the Government, on the total value of pension benefits that you could build up over your lifetime. The standard LTA was £1,073,100 (for 2023/24 tax year). The LTA was removed from 6 April 2024, but it’s still relevant if you took out any lifetime allowance protections or took your pension before 6 April 2023.

The changes we're making to your pension mean that we need to increase how much you're getting and pay you a back payment.

Because of this, you will have used more of your LTA.

You must now check how much LTA you used and tell Aptia if you've breached it.

The Scheme is not able to do this for you.

If you are in this position, you must tell Aptia. This is your personal responsibility.

Please remember that the LTA limited the value of benefits you could draw in your lifetime from all registered pension schemes, including those from the Scheme (ignoring State pensions and pensions payable after your death). The Trustee only holds information about your Scheme benefits and so cannot tell you how much of your overall LTA you have used up by taking benefits from other pension schemes.

You can read more about the Lifetime Allowance and the different forms of protection on the HMRC website.

For ‘phase 2’ pensioner members (who have not received figures yet)

Q14. What is GMP?

GMP is a minimum pension that a workplace pension scheme provides.

It only applies to people who were contracted out of the Additional State Pension (or State Earnings Related Pension) between 6 April 1978 and 5 April 1997.

Schemes could 'contract out' so that members and the employer could save on National Insurance. In return, the scheme had to guarantee that the member would get a certain minimum level of pension when they retire.

This minimum level of pension was designed to be at least as much as the Additional State Pension a member would get if they had not been contracted out.

Q15. I have GMP but I haven’t received a letter yet. When will I get one?

You should have received a letter about your GMP, in September 2025.

If you have not received a letter, please contact Aptia.

Q16. Is every member who has GMP having their GMP converted?

Yes. All affected members of the Scheme will have their GMP converted into normal pension. This will happen at different times for different members.

Q17. When will my GMP be converted?

This answer is for Phase 2 members. We wrote to you in September 2025 to explain that your figures aren’t ready yet. We’ll be in touch again when your figures are completed to let you know when your GMP will be converted. We plan to do this in autumn 2026.

Pension Increase Exchange (PIE)

Q18. Which members are being offered PIE?

This PIE offer is for any member who is already getting their Scheme pension, as long as the part of their pension built up before 6 April 1997 is more than £500 a year and receives annual increases.

You might also receive a PIE offer if you previously accepted a PIE offer when you retired and now have more than £500 a year of pension with increases that can be exchanged.

Some members might not have had a PIE offer.

The main reasons for this are that they:

are receiving a child’s pension

As a child’s pension is not payable for life, it doesn’t qualify for the PIE offer.opted out of an offer or did not reply

If a member was over 80 on 30 April 2025, we wrote to them earlier this year to explain that they needed to opt in if they wanted a PIE offer. If we did not hear from them, we did not send them a PIE offer. If a member is under 80, we gave them the option to opt out of the exercise. If they opted out, we did not send them a PIE offer.are going through a divorce

During divorce proceedings, pensions can become subject to a court order. This means they cannot get a PIE offer.are in phase 2

Because we will be calculating GMP for these members in 2026, any PIE offers will also wait until then.

Q19. Another member I know has been offered PIE, but I haven’t. Why is that?

If you received a letter from us about converting your GMP but you didn’t receive a PIE offer, it’s because we can’t make PIE available to you. You can find out more about why in the Q&A above: ‘Which members are being offered PIE?’

Q20. I’ve received a PIE offer, but there’s no information about GMP or changes to my pension. Is that right?

If you only built up pension before 6 April 1978, then GMP will not be part of your benefits. This means there are no changes due to your pension, so we have not written to you about it.

Q21. Why can’t I exchange the increases on pension I built up after 5 April 1997?

The law does not allow you to exchange increases on pension built up after 5 April 1997.

Q22. I definitely want to choose PIE. Do I still have to get advice from Chase de Vere?

Yes, you need to have an appointment with Chase de Vere before you can choose PIE.

If the part of your pension you’re exchanging is worth more than £500 a year, you must get advice from Chase de Vere.

If you live outside the UK, Chase de Vere can only give you guidance, not advice. They will explain more about this when you talk to them.

Chase de Vere is an independent financial advice company. ScottishPower is paying for them to give you advice. They will be paid no matter what decision you make.

You will not have to pay anything.

Chase de Vere is regulated by the Financial Conduct Authority (FCA) under the reference number 137914. You can see them on the FCA register at register.fca.org.uk

Q23. Can I use my own financial adviser to take up this PIE offer?

Your financial adviser can look over this PIE offer if you want them to. You might need to pay them to do this. However, to take up this PIE offer you must have an appointment with Chase de Vere. ScottishPower will pay for your appointment. It won’t cost you anything.

You need to use Chase de Vere so that ScottishPower and the Trustee can be sure you have had appropriate advice or guidance. Chase de Vere are properly qualified and independent advisers who understand the Scheme and this PIE offer.

It’s not possible for the Trustee to check every member’s personal financial adviser.

Q24. If I don’t take this PIE offer, will I get another one?

Currently, ScottishPower have no intention of offering PIE again to pensioner members who receive this offer in 2025.

If you choose not to take this PIE offer, you might not be offered PIE again.

If you are in phase 2, PIE offers will be made in 2026.

Q25. Do I need to declare the financial advice from Chase de Vere as a ‘benefit in kind’ on my tax return?

No. If you were employed by ScottishPower in the current tax year then ScottishPower will pay the tax charge associated with paying for your financial advice. So, you do not need to report this in your tax return.

Q26. What should I do if I have not received my advice report or offer acceptance confirmation?

If you have taken advice from Chase de Vere but have not received a copy of your report within 2 weeks, or if you’ve sent a form saying you want to accept your offer but not had a reply within a week, please check your email spam folder.

If it’s not there, please contact Chase de Vere

If you want to choose PIE, you need to make sure Chase de Vere has received your completed forms by 12 December 2025.

Q27. What should I do if there’s something wrong with my PIE offer?

If your personal information does not look right in your PIE offer, please get in touch with Chase de Vere to let them know.

Your PIE offer is based on the personal information we hold about you. If any of that information is incorrect, we may have to amend or withdraw your offer.

Q28. Why are you telling me about GMP and PIE at the same time?

Although GMP and PIE are separate exercises, we are telling you about them at the same time. This is because once your GMP is converted to normal pension it can be included in the calculations for your PIE offer.

Q29. Do I have to take the PIE offer?

No. You do not have to take the PIE offer.

If you are not sure if PIE is the right option for you, please contact Chase de Vere. They will give you independent financial advice tailored for your circumstances, from a qualified professional expert. There is no cost to you for this advice. You can still decide not to take the PIE option after taking advice.

Q30. What have members said about Chase de Vere?

We have had lots of positive comments from members about their experience of talking to Chase de Vere, regardless of whether they ended up taking the PIE offer.

Here’s what six Manweb Group Scheme Members said about the process:

"The process wasn’t daunting but very straightforward. The adviser guided me through the recommendation report and was very helpful, putting me immediately at ease, whilst discussing and explaining key points around the offer and my pension."

"From the very first contact through to the final conclusion, my allocated adviser was very clear, very knowledgeable and made the process easy to understand… I feel it would definitely help members who may have any concerns or are unsure as to which option is appropriate for them."

"He explained everything in the letter clearly and precisely and asked pertinent questions to help with understanding my personal situation. After around half an hour to 40 minutes we were able to agree on what would best suit my individual circumstances."

"The consultation was straightforward. My Chase de Vere adviser was polite and friendly and was able to answer any questions I had. His recommendation was in line with my own thoughts, and this became clear through our conversation."

"I would like to thank my Chase de Vere adviser very much for his assistance with the Pension Increase Exchange (PIE) offer. His advice is much appreciated; he was very conscientious and thorough in our discussions. It really has been a pleasure dealing with my adviser on this matter."

"I took part in the MANWEB PIE exercise. This was carried out by Chase de Vere very efficiently and was an easy exercise to complete from the initial explanation through to completing the whole advice process. My adviser was very helpful and explained everything clearly making the process quick and easy to follow."

Q31. Why are you making this PIE offer now?

In 2017, we asked members to vote about whether to introduce a PIE offer for members who are approaching retirement. Members voted in favour of doing this.

Some members didn’t receive an offer at that time. So, we’re offering PIE again so that more members have the chance to take it. The offer is based on the same terms and conditions as before.

We wrote to members to explain we would be making PIE offers, and if they did not want to receive more information from us, they could opt out at that point. For members who opted out, we have not sent any further information or offer.

We’re offering PIE at the same time as doing GMP conversion, because it’s more efficient for the Scheme to combine these two exercises together.

Q32. Is the advice from Chase de Vere truly impartial?

Yes. Chase de Vere is an independent financial advice company. ScottishPower is paying for them to give you advice. They will be paid no matter what decision you make. It does not make a difference to them if you choose PIE or not.

You will not have to pay anything for their advice.

The Company and Trustee have chosen to follow a pensions industry code of good practice. The PIE option and the arrangement for providing you with advice meet the requirements of this code.

GMP consultation

In September 2024 we consulted with members on a plan to convert everyone’s Guaranteed Minimum Pension. That consultation has now ended.

These Q&As answer some of the questions that members had at the time.

What is Guaranteed Minimum Pension?

GMP is a minimum pension that a workplace pension scheme provides.

It only applies to people who were contracted out of the Additional State Pension (or State Earnings Related Pension) between 6 April 1978 and 5 April 1997.

Schemes could 'contract out' so that members and the employer could save on National Insurance. In return, the scheme had to guarantee that the member would get a certain minimum level of pension when they retire.

This minimum level of pension was designed to be at least as much as the Additional State Pension a member would get if they had not been contracted out.

Why is this change happening now?

There was a High Court legal judgment about GMP in 2018. The judgment said that schemes must equalise benefits for the effect of unequal GMPs. All schemes like ours have to follow the judgment, but there is no deadline for doing so.

Like most pension schemes affected by the changes to GMP, we’ve been thinking carefully about how best to review pensions since 2018. We’ve also taken a lot of expert advice. The process to review and potentially change members’ benefits is complex. We wanted to be certain that our plan to proceed was the right one.

Now that we’ve agreed our approach and have what we need, we’re able to submit our proposal to members for consultation.

You can watch this 2-minute video about why pension schemes like ours are doing these checks. This video was created by the UK pensions industry, so it gives general information about these checks rather than specifics for our scheme.

I have received a letter but another member that I know has not. Why is that?

We’re only writing to members who have GMP.

We have not written to members who:

left the Scheme before 6 April 1978 (when GMP began)

joined the Scheme after 5 April 1997 (when GMP ended), or

joined another scheme after 5 April 1997 that later merged into this Scheme

In the next newsletter, we’ll update all members about what’s going on. But if you know a member who you think should have heard from us, please ask them to contact us. For example, someone might have recently moved house or been away from their main address.

I haven’t started taking my benefits yet. Will my retirement quotation be accurate?

If you ask for a retirement quotation before taking your benefits, this will not reflect the impact of any changes for GMP. This is because we will not have checked your pension and GMP yet.

If our calculations mean that your pension is due to increase, we’ll include information about how it’s changed when we write to you in the run up to taking your benefits.

Will there be any further changes in the future?

We are not planning to make any more checks or changes of this nature in the future, but we might need to do so if pension legislation requires it.

If we do need to make any further changes, we’ll contact you about them.

Does this change the benefits that are payable when I die?

If you receive a small increase to your pension, your death benefits will increase too.

And if your pension stays the same, your death benefits will also stay the same.

Why is the Trustee proposing to convert GMP?

Converting GMP is one of the methods that the law allows us to use to equalise pensions for the effect of unequal GMPs. We have decided it is the most appropriate method for this scheme. It is not a legal requirement to convert GMP to normal (non-GMP) pension. But if we do not do this, it will more than double the calculations that are currently needed for every member request. This would make the administration of the Scheme much more complicated, which would be more expensive in the long run and create greater risk of error.

Is the Trustee allowed to make the proposed change?

Yes, pensions law does allow the Trustee to change the Scheme’s benefits in this way. However, certain steps need to be taken first to protect members’ pensions, given that the change we are proposing affects benefits that have already been built up.

The Trustee has taken legal and actuarial advice and is following guidance from the Department of Work and Pensions. The Trustee is consulting with all affected members of the Scheme.

Are you providing members with financial advice?

If you would like advice about your pension you should speak with an authorised independent financial adviser (IFA). Neither the Trustee nor anyone involved with the Scheme is allowed to provide financial advice.

If you do not have an IFA, you can find one by searching online. MoneyHelper has an online directory of IFAs. Go to moneyhelper.org.uk and search for ‘adviser’.

What happens if I die before you have contacted me again about money I am due?

If you are due an increase or a back payment, we will aim to pay these to your estate or any dependents.